45+ what percentage of income should mortgage be

Check Your Official Eligibility Today. Ad 5 Best House Loan Lenders Compared Reviewed.

Public Attitudes To A Wealth Tax The Importance Of Capacity To Pay Rowlingson 2021 Fiscal Studies Wiley Online Library

3545 Of Pretax Income.

. So taking into account homeowners insurance and property taxes. Estimate your monthly mortgage payment. Web The Traditional Model.

Some applicants get approved with DTIs or 45. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad Calculate Your Payment with 0 Down.

Apply Get Pre-Approved Today. Web The 3545 model. Compare More Than Just Rates.

Web If earned commission tops 25 percent of the borrowers total yearly income then either the 1005 or the borrowers recent pay stub and IRS W-2 forms as well as copies of the borrowers. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. However there are multiple factors to consider when budgeting to buy a home.

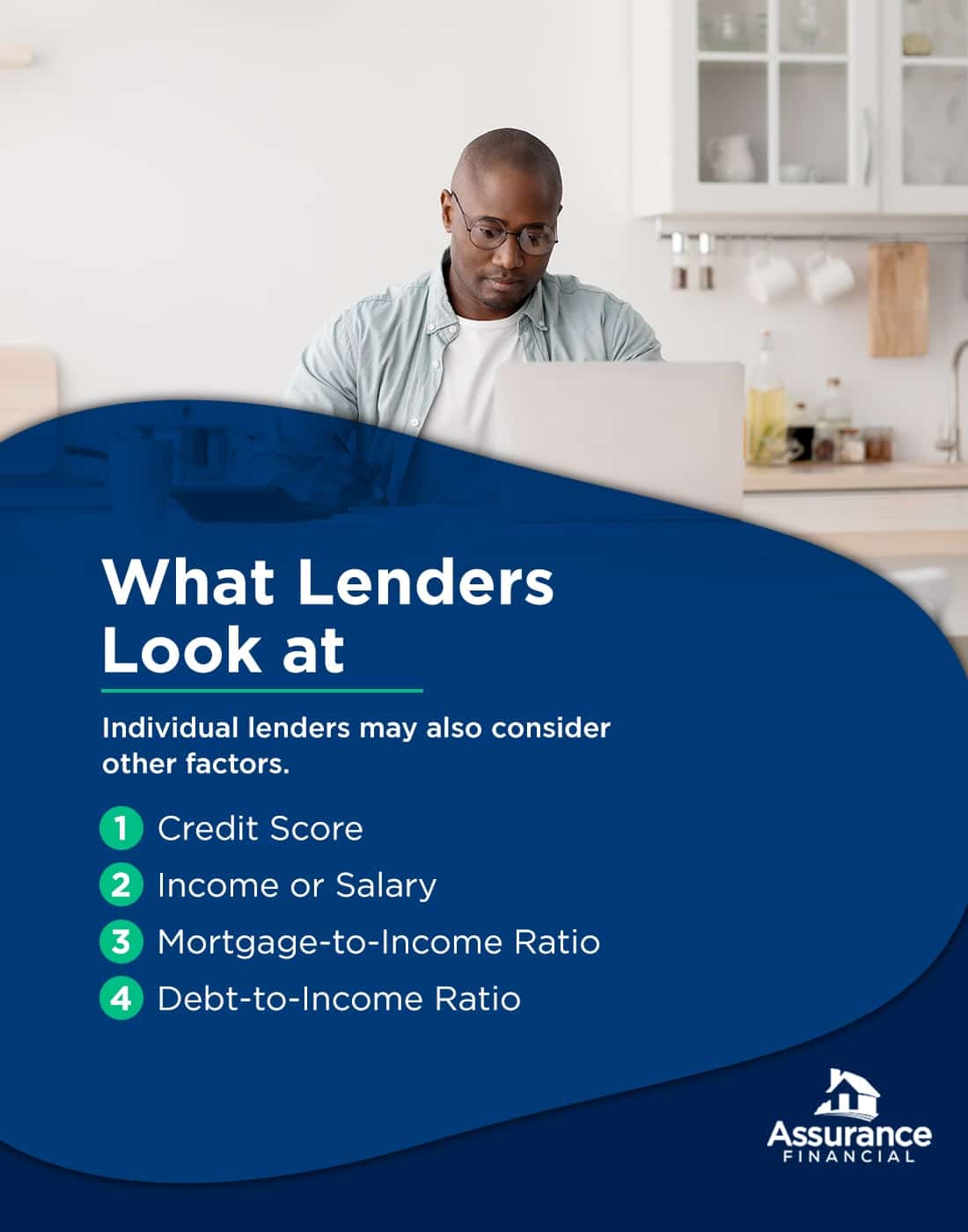

Web Most lenders look for a maximum DTI of 40 on applications for most sorts of mortgages. For example if your monthly income is 5000 you can. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month.

No more than 30 to 32 of your gross. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Compare the Best House Loans for March 2023.

Updated FHA Loan Requirements for 2023. Ad See how much house you can afford. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance payments. Find A Lender That Offers Great Service. And you should make sure that you dont go over 36 of.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. But thats a very general guideline. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Comparisons Trusted by 55000000.

What Percentage Of Your Income Should Your Mortgage Be. 2000 is 33 of 6000 If you use a calculator youll need to multiply the. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage.

Other mortgage-to-income budgeting considerations.

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Explaining The Declined Affordability Of Housing For Low Income Private Renters Across Western Europe Caroline Dewilde 2018

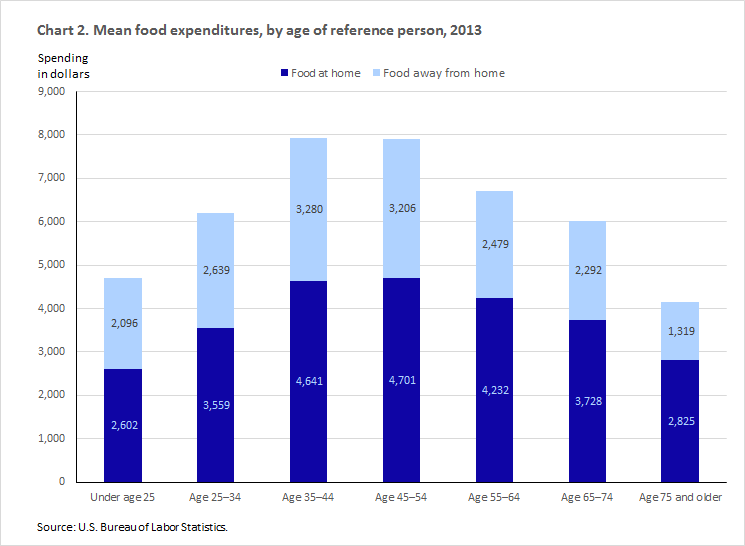

Consumer Expenditures Vary By Age Beyond The Numbers U S Bureau Of Labor Statistics

What Size Mortgage Can I Afford Freeandclear

Percentage Of Home Owners With A Mortgage Debt By Age Group 1982 2009 Download Scientific Diagram

Housing Expense Guideline For Financial Independence

What Percentage Of Income Should Go To Mortgage Morty

45 Baby Boomer Spending Habits Statistics For 2022 Lexington Law

A Straightforward Guide To Financial Planning For The Future Ebook By Anthony Vice Epub Rakuten Kobo Philippines

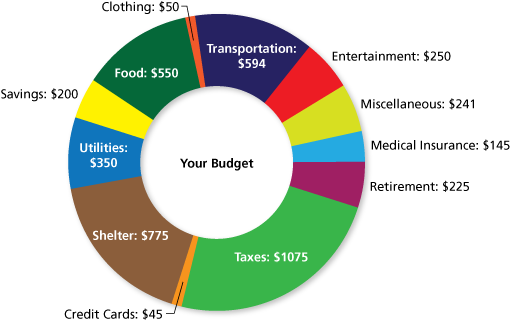

Math You 2 4 Budgeting Page 92

What Is The 28 36 Rule Lexington Law

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Redfin Sun Belt Buyers Need 40 More Income Than They Did A Year Ago To Afford A Home The Business Journals

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

How Much Of My Income Should Go Towards A Mortgage Payment

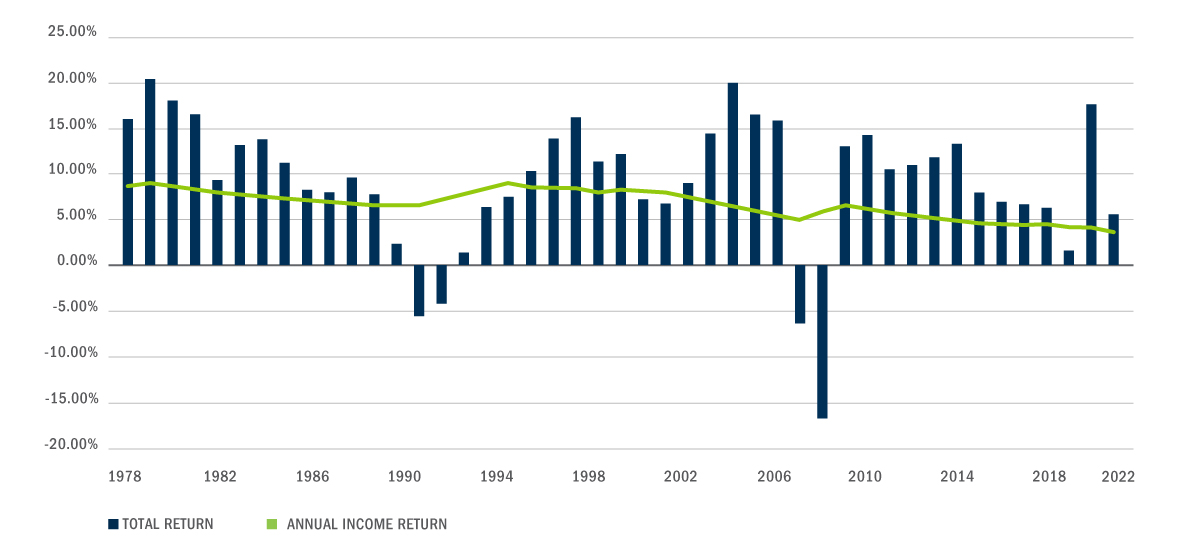

Institutional Private Real Estate Bluerock Total Income Real Estate Fund

Proportion Of Population In Low Income Households Ahc Fixed Line Download Scientific Diagram